The 450-page Global Aesthetic Services Market Analysis and Opportunity Assessment (2023-2033) is quite a bedtime read. I'd say it's a page turner, but almost everything is digital these days! And the aesthetic market isn't any different. So what can we expect between now and 2033? Who's doing what? And how can the aesthetic industry, providers and stakeholders win?

Let this sink in first

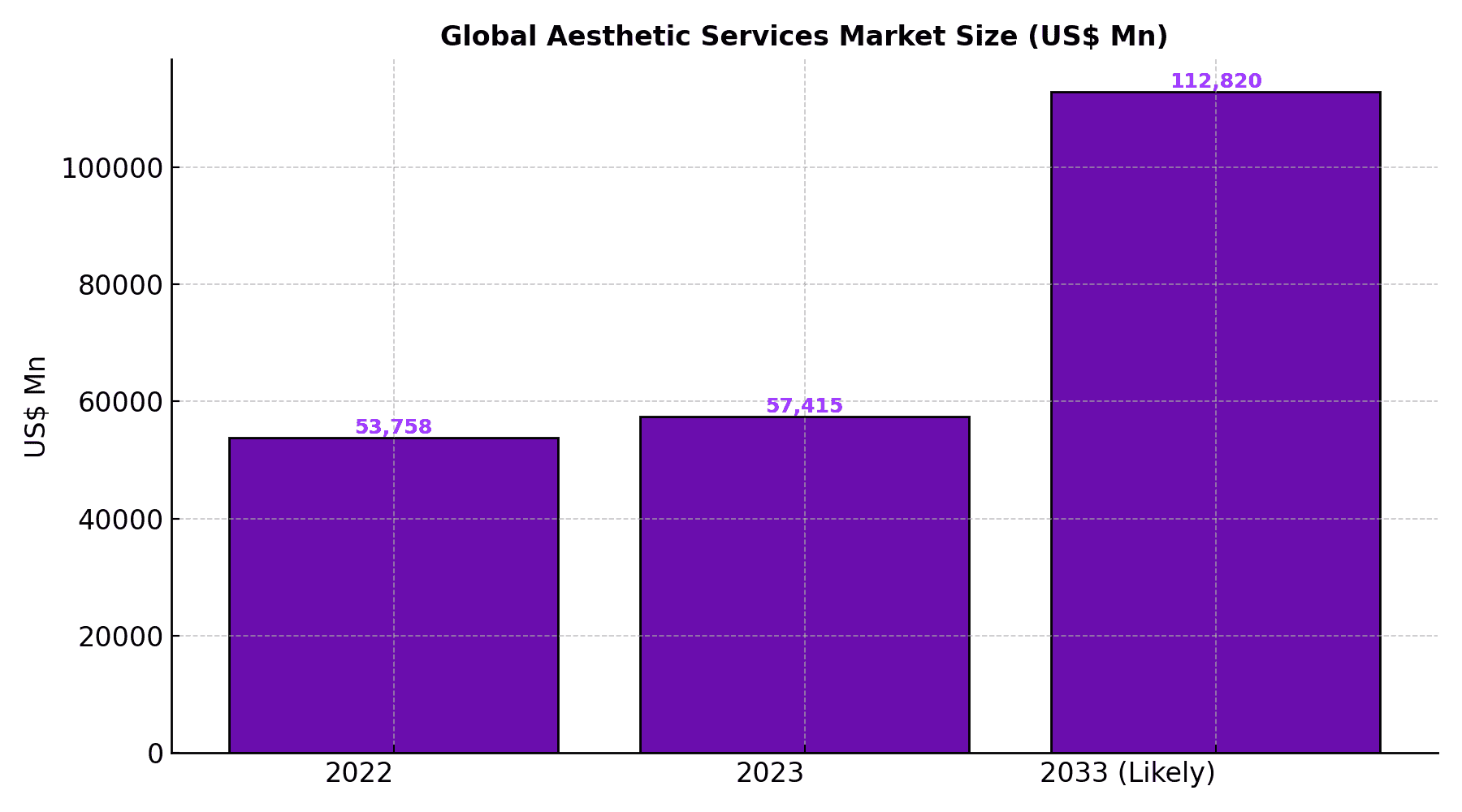

- The aesthetic services market is projected to grow from US$57.4B in 2023 to US$112.8B by 2033 (7.0% CAGR). Patients will discover, decide, and follow‑up online first; winners will master remote intake, education, and verification. Surprise surprise.

- Non‑surgical is the growth engine; 35–50 is the power segment (think jowl-busting, tissue tightening and cosmeceuticals that work); men and Gen Z are rising.

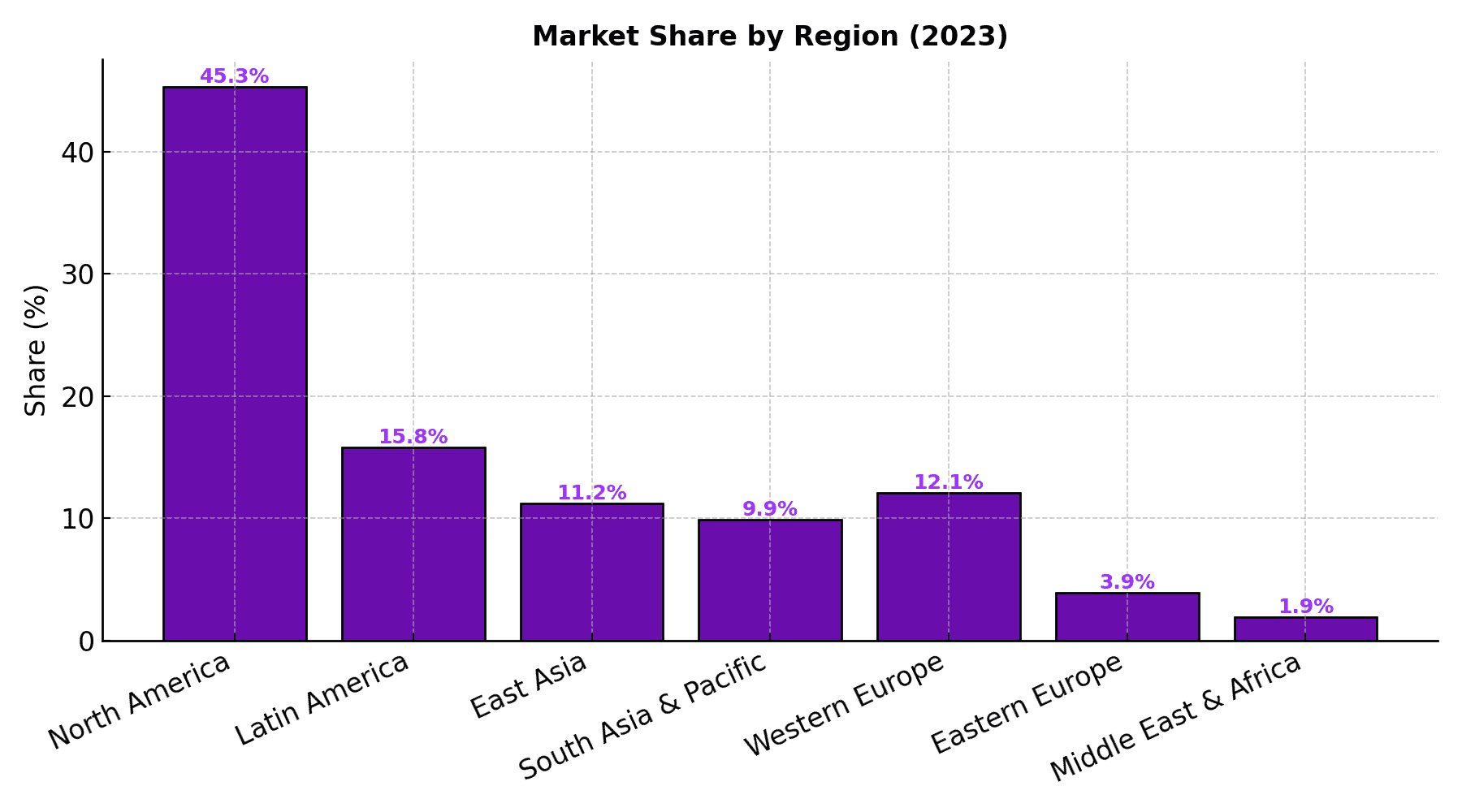

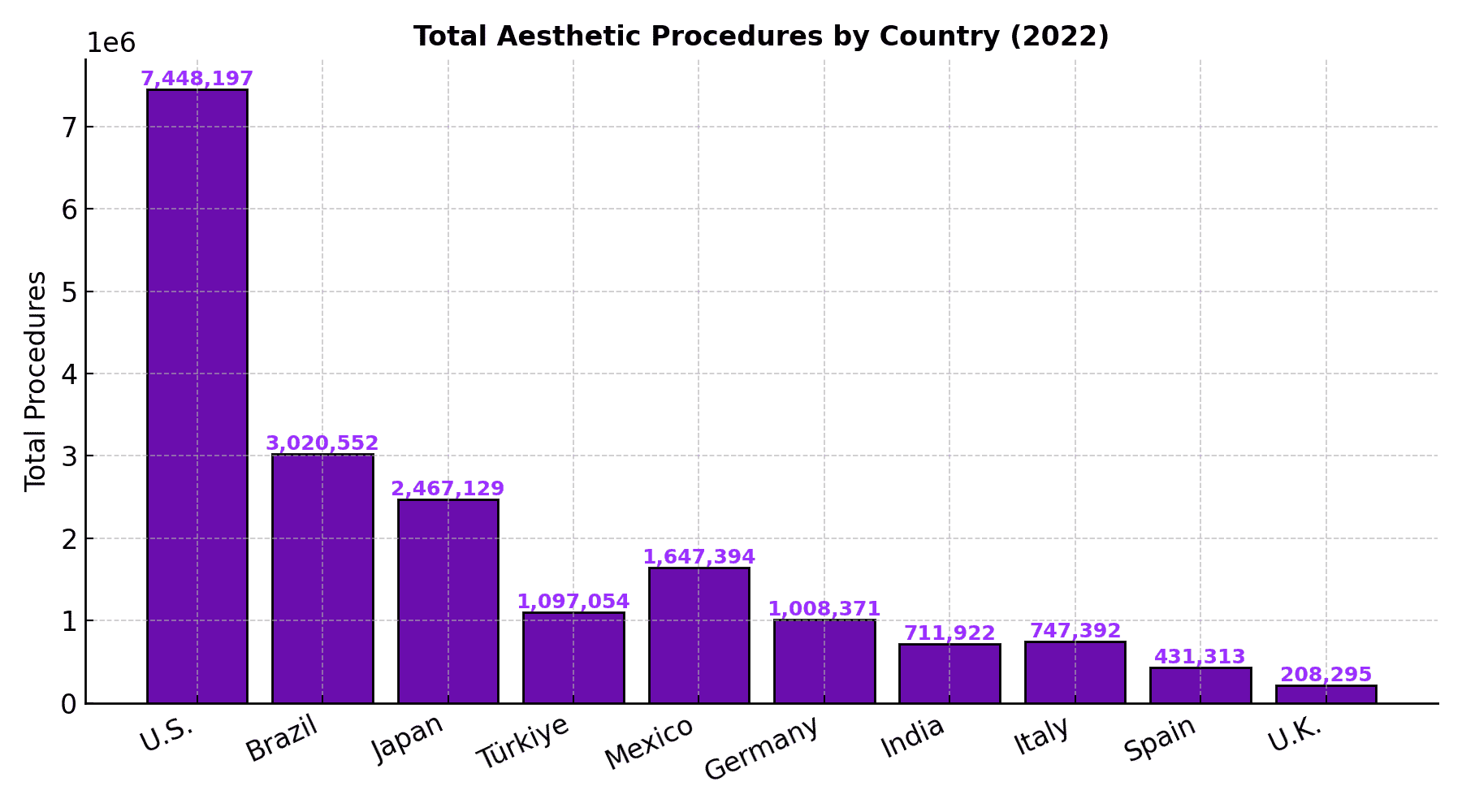

- North America leads (45.3% share), but LATAM and East Asia offer outsized growth—with Brazil, Japan, Turkey among the most active markets by procedure volume. Personally I thought Korea trumped Japan but there you go.

- Trust, speed, and combination therapies will define the next wave. Regulators are tightening, especially around toxins and data privacy. (I think they should be as concerned about fillers TBH).

Market at a glance

The report sizes the global aesthetic services market at US$57,415.2M in 2023, growing to US$112,820.2M by 2033 on the back of a 7.0% CAGR.

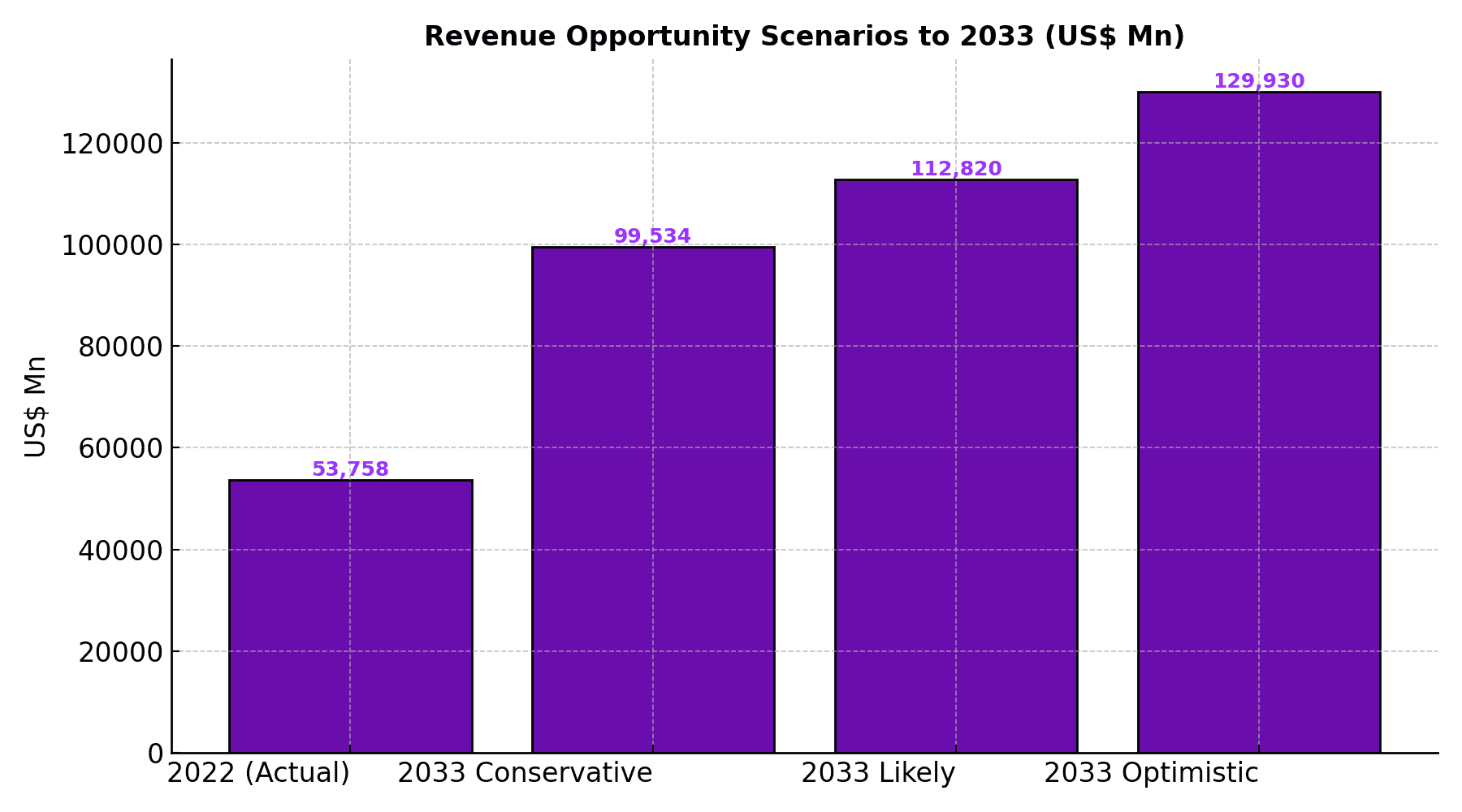

Future Market Insights (FMI) also models three scenarios for 2033: US$99.5B (Conservative), US$112.8B (Likely), and US$129.9B (Optimistic).

Where the demand is (and who it’s from)

By procedure type

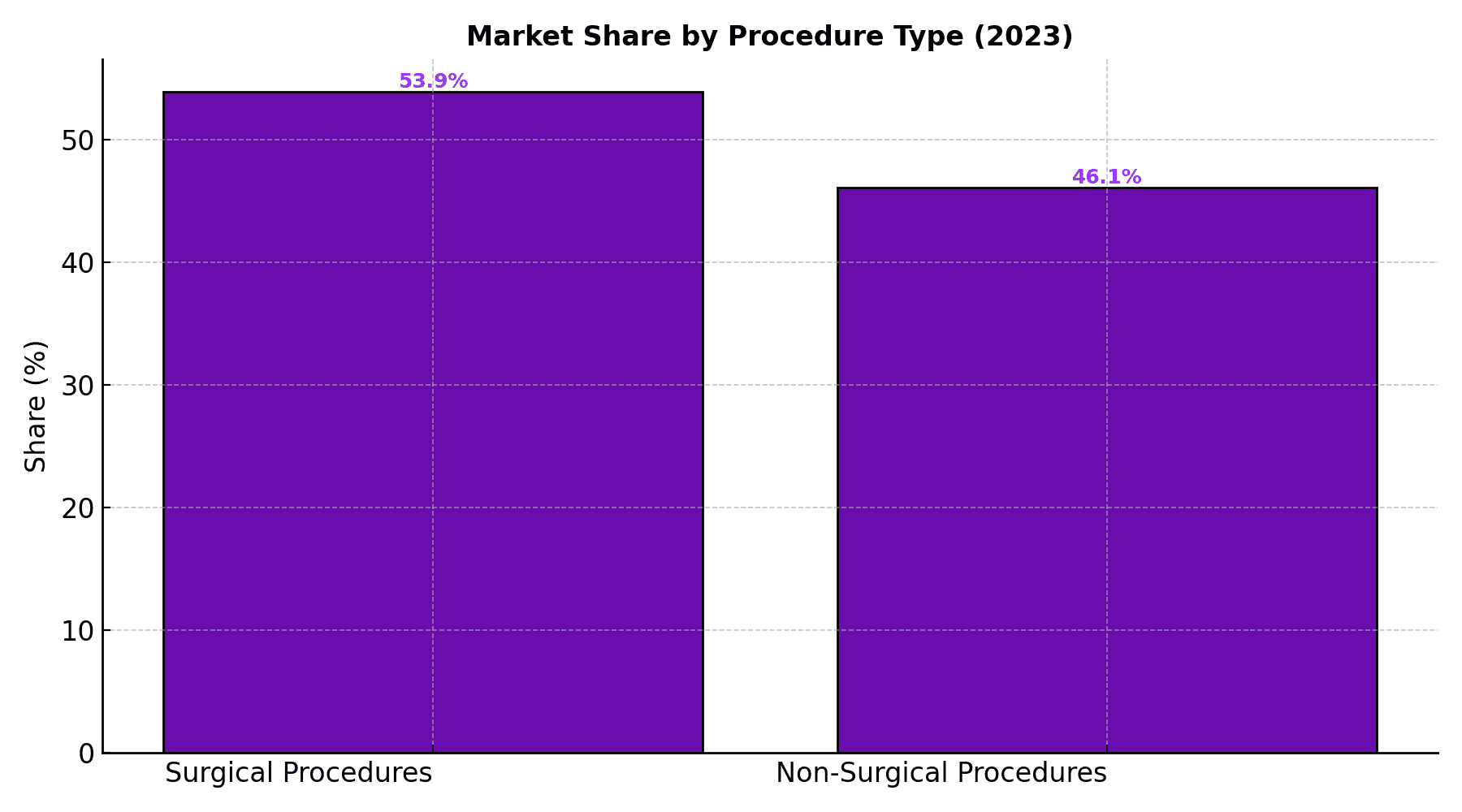

Despite a long tail of minimally invasive options, surgical procedures still account for 53.9% of value in 2023, with non‑surgical at 46.1%—the latter is the growth engine given lower risk, cost, and downtime.

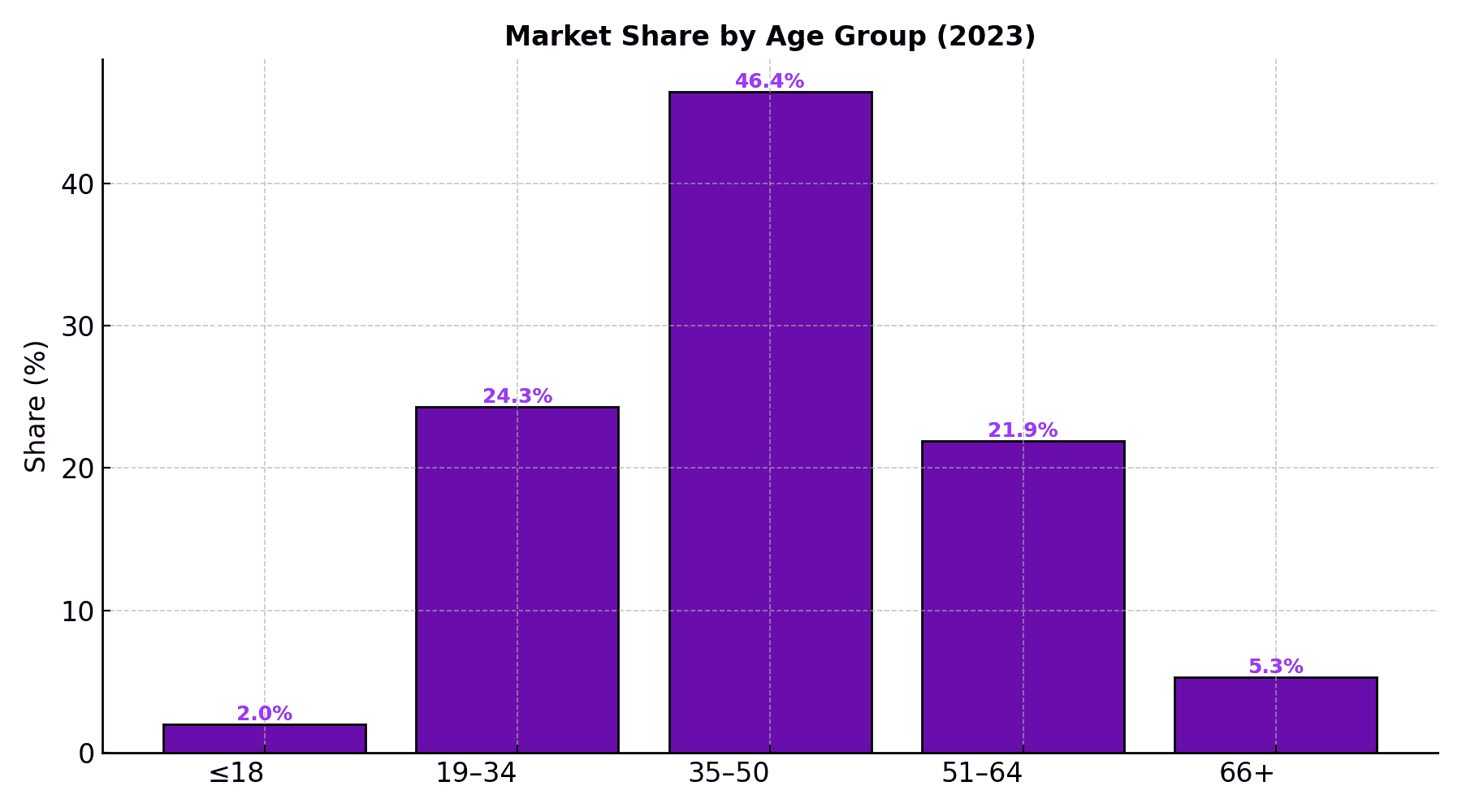

By age

35–50 is the power cohort at 46.4% share; 19–34 follows with 24.3%. This is an interesting one. As life-expectancy rises, people will be healthier for longer, and tomorrow's 70 year-old will feel and look like today's 50 year-old.

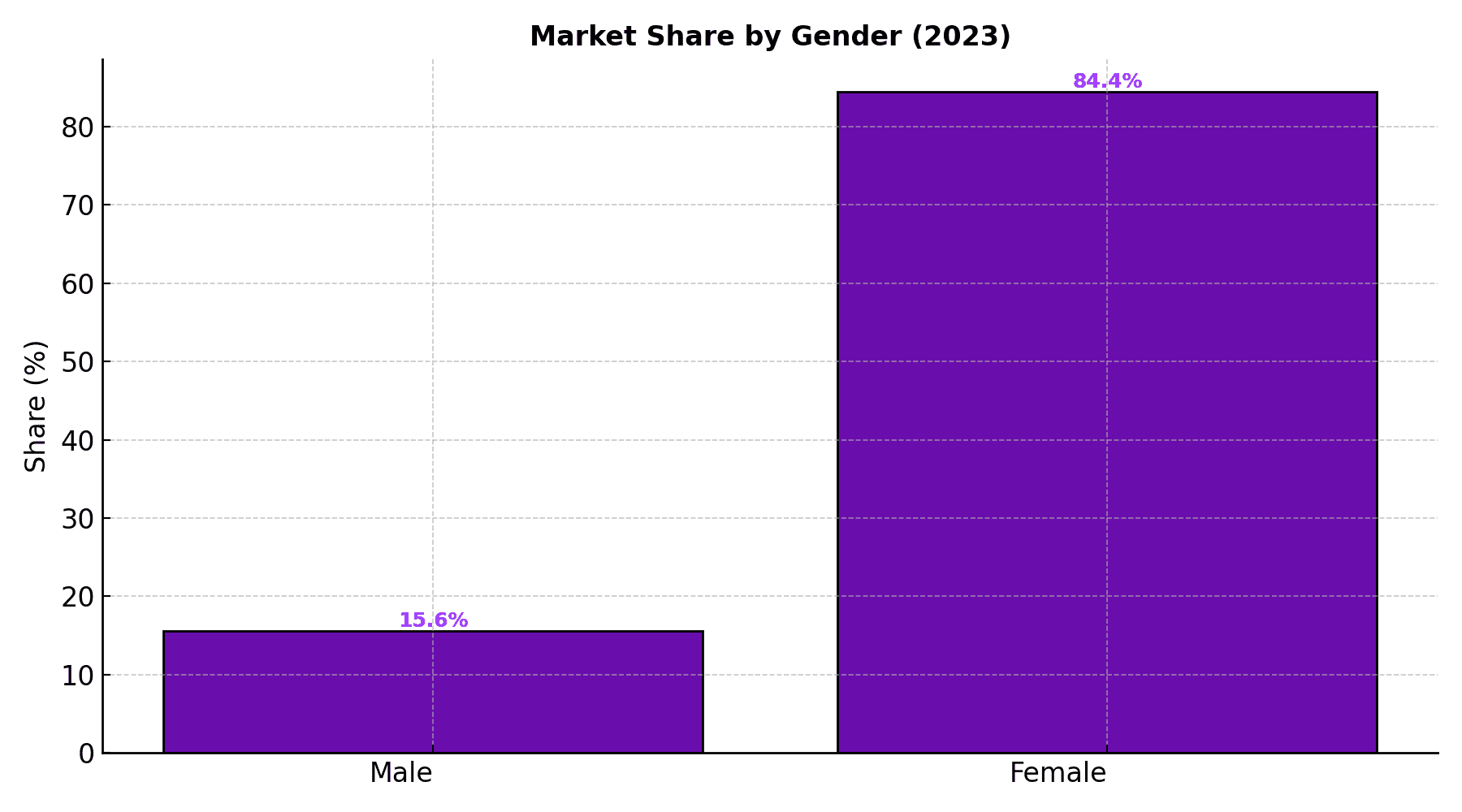

By gender

Females represent 84.4% of spend; males 15.6%—and growing. But men tend to want procedures and giving them remote access to expertise lowers the threshold for booking.

Where the procedures happen

North America is the largest region (45.3%), followed by Latin America (15.8%), Western Europe (12.1%), East Asia (11.2%), South Asia & Pacific (9.9%), Eastern Europe (3.9%), and Middle East & Africa (1.9%).

At a country view, procedure volumes underscore where demand concentrates today:

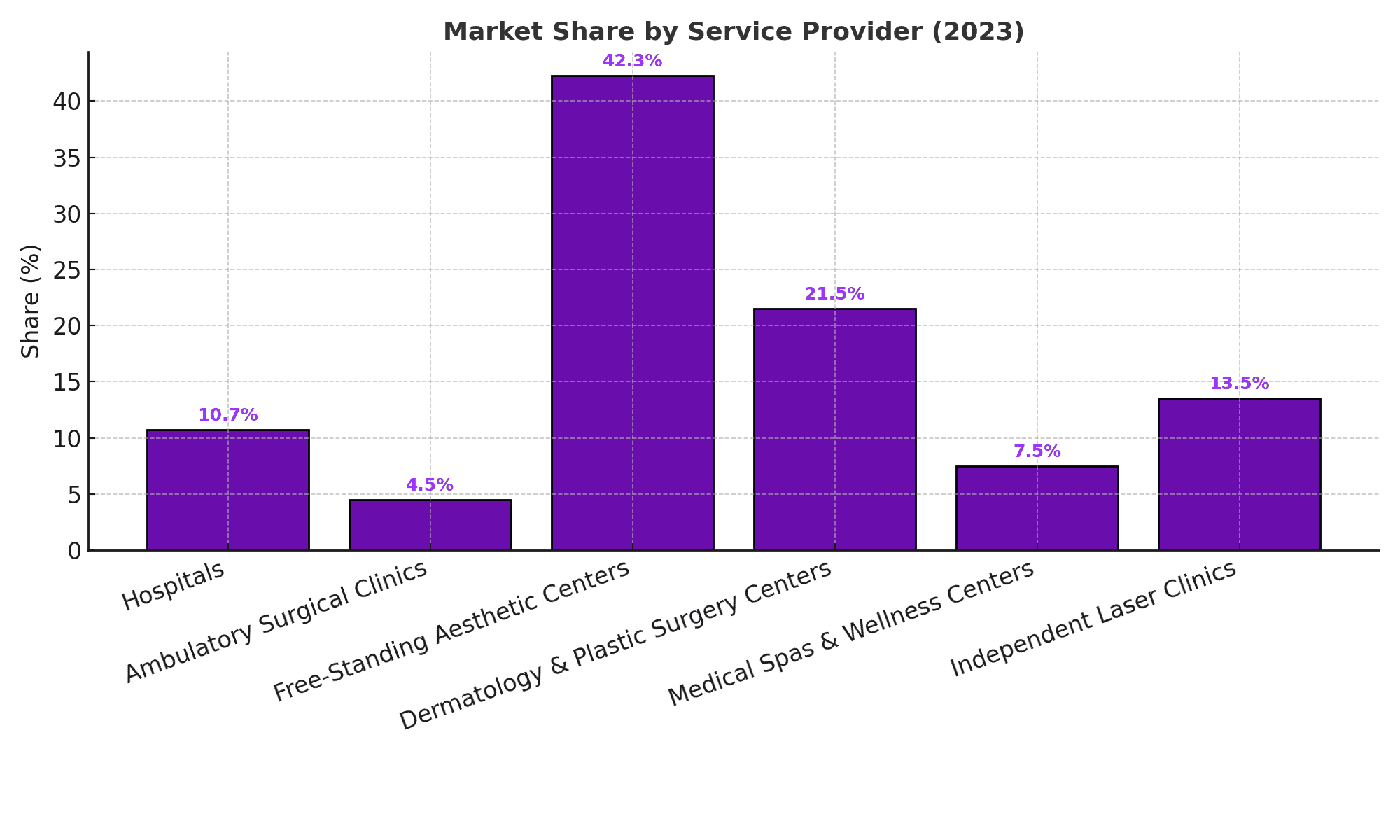

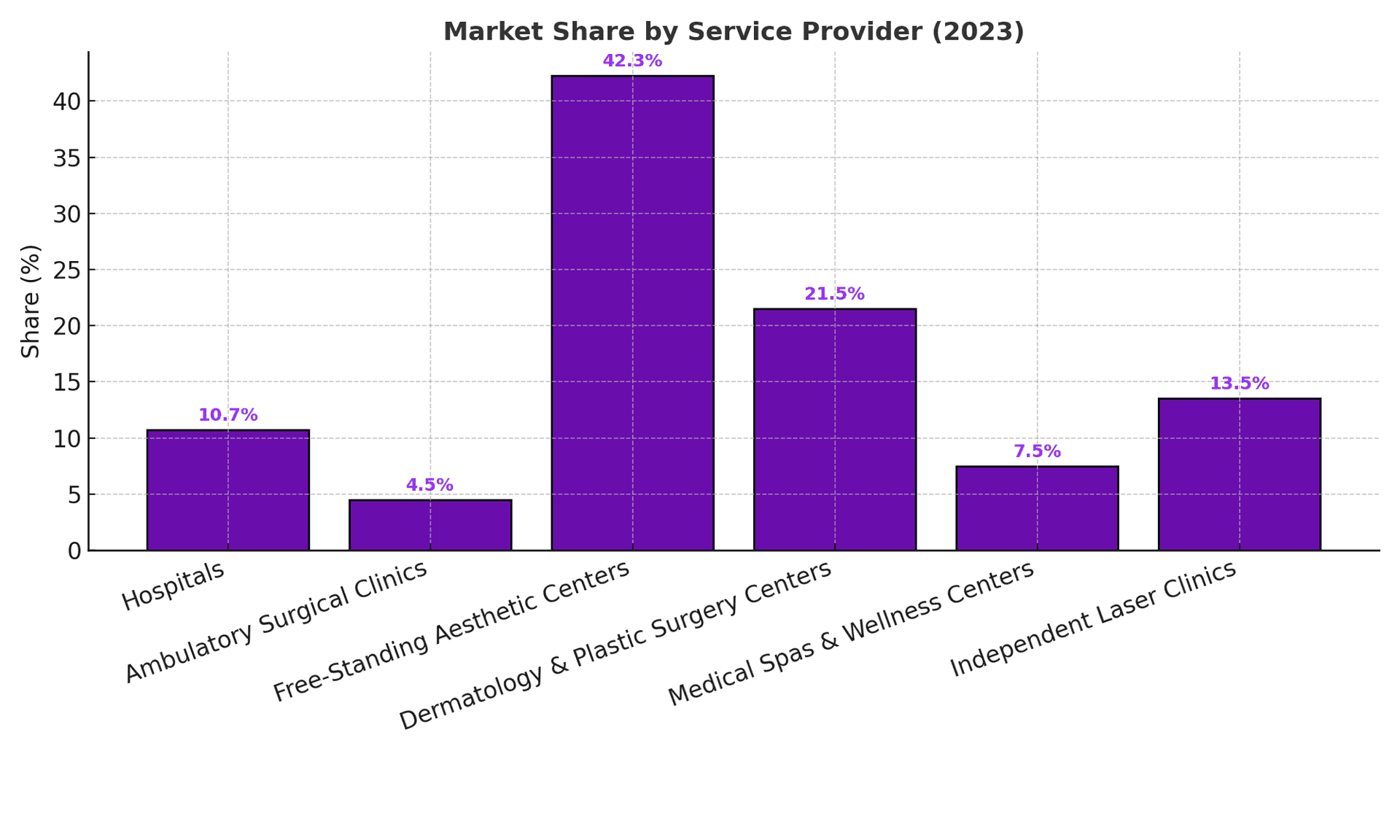

And by site of care, free‑standing aesthetic centres dominate with 42.3% share, followed by dermatology & plastic surgery centres (21.5%), independent laser clinics (13.5%), hospitals (10.7%), medical spas (7.5%), and ambulatory surgical clinics (4.5%).

Trends reshaping the funnel

Access is expanding, fast. Big chains and PE‑backed injectables clinics are growing in the U.S. and Brazil; in China, digital platforms are opening access in third‑ and fourth‑tier cities. This is particularly relevant where people don't want to drive significant distances, deal with traffic, or find parking in urban areas.

Social is the front door. Social media coverage of dermal fillers increased 8× from 2010–2020; men and <25yrs now account for ~60% of X mentions—a strong signal of where discovery happens.

Combination therapy is the standard of care. Layering neuromodulators, fillers, and energy devices is becoming the norm for natural, durable results. This has always been my own mantra. Combination is key.

Speed + evidence. Patients increasingly seek “faster, efficient treatment with clinically proven record”—injectables for immediate effects; lasers for durable outcomes.

From a consumer lens, HA fillers rank highest on sentiment given biocompatibility and reversibility; CaHA is moderate; poly‑L‑lactic acid is widely used but permanent fillers, PMMA and other stimulators are not widely used given concern over side-effects and complications.

Risks & constraints to watch

Cost & repeatability. Many fillers are absorbable (3–24 months), requiring multiple sessions and raising total cost of care. Now some clever clogs medics are warning the public that HA fillers can last years, as though it's a bad thing. Unless the hyaluronic acid filler is not playing ball and acting up, just sitting there is okay.

Counterfeit toxins (APAC focus). Unauthorised imports—especially in China—pose safety and trust challenges for providers and patients. This happened recently in the UK. We must do more to educate people on the dangers of going for cheap injections or non-medical injectors.

Post‑procedure complications. Even with high safety, issues like bruising, migration, or rare adverse events reinforce the need for rigorous education and follow‑up.

Regulatory snapshots

U.S.: FDA regulates devices and injectables; only four botulinum toxin products are approved.

Europe: GDPR governs patient data; injectable practice standards vary by country, with gaps that still allow non‑medical providers to perform some treatments.

China: Only two officially registered botulinum toxins (BTXA and Botox) with customs loopholes fueling counterfeit entry; NMPA oversees medical devices/cosmetics.

Japan & India: Device/drug regulation under PMDA/MHLW (Japan) and DCGI (India); professional standards enforced by medical bodies.

Strategic implications for providers (and why digital wins)

Design or adopt a non‑surgical, remote funnel. Because non‑surgical drives growth, build asynchronous intake (photos/video), AI‑guided education, and fast quoting for injectables and skin—then graduate patients to in‑clinic combo plans.

Meet your core segment where they are. The 35–50 cohort values time and predictability—optimise for speed to clarity (clear options, evidence, price bands) and virtual follow‑ups.

Treat social as your front door. Given the 8× rise in social coverage and the dominance of men/<25 in filler chatter, wire your content to one‑tap remote pre‑consults and track content → consult → case. Sharing a link to a seamless remote assessment funnel is an irresistible user experience for people serious about connecting.

Build trust‑by‑design. Surface product provenance, clinician credentials, and clear aftercare; this is crucial in APAC markets with counterfeit risk—and everywhere as patients become more discerning.

Platform economics matter. Independents (the largest provider segment at 42.3%) can fight above their weight by adopting a shared digital stack for intake, education, tele‑follow‑up, and lead routing.

How we’re aligning at MeTime

From our vantage point, three pillars stand out:

- Digital front door: We prioritise remote pre‑consults (async intake with guided photos), AI‑assisted education, and smart triage so in-clinic time is spent with ready‑to‑treat patients. This matches the market’s shift to faster, evidence‑based pathways.

- Non‑surgical to combination plans: We streamline the journey from injectables/skin to multi‑modality care—planned remotely, executed in clinic—because combination therapy is becoming standard.

- Trust & compliance: We surface verification signals, keep data privacy central, and standardise tele‑follow‑ups—critical in markets with counterfeit risks and varying practice standards. Patients feel reassured that they can open the app, text and add a photo if they have a question or concern.

If you operate a clinic or med‑spa and want to test a remote‑first flow that boosts conversion while protecting trust, I’m happy to share our experience with 4500 patients.

The Road Ahead: Where Aesthetics Fits in the Bigger Picture

Aesthetic services are more than just a growth niche—they’re the heartbeat of the entire medical aesthetics industry. While devices and products make up the rest of the US$155B parent market, it’s the services—the procedures themselves—that shape the patient experience, build trust, and ultimately decide whether outcomes meet expectations. In fact, services already represent over a third of the total medical aesthetics market, and their role will only expand as digital access lowers barriers and broadens adoption.

That means providers who rethink how services are discovered, delivered, and followed up are the ones who will capture disproportionate value in the next decade. The opportunity is no longer just about adding new treatments—it’s about re-engineering the patient journey around speed, clarity, trust, and personalisation.